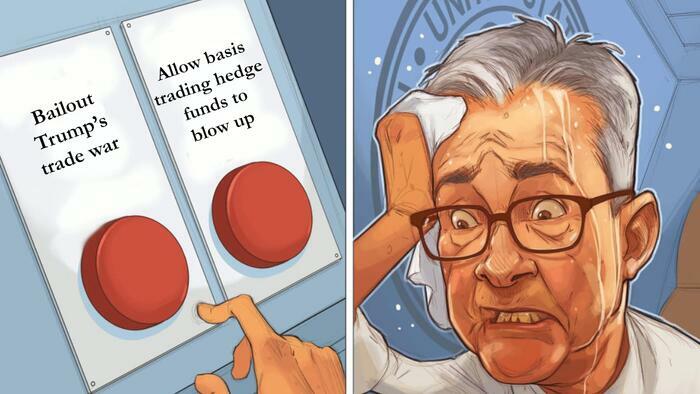

"The Federal Reserve will need to step in to stabilize the Treasury market if a rout that briefly propelled the US’s long-term borrowing costs above 5% continues, according to Deutsche Bank AG." ( https://www.bloomberg.com/news/articles/2025-04-09/deutsche-bank-sees-fed-doing-emergency-qe-if-bond-rout-goes-on | https://twitter-thread.com/t/1909913951216771306 )

https://www.zerohedge.com/markets/absolutely-spectacular-meltdown-basis-trade-blowing-sparking-multi-trillion-liquidation | https://twitter-thread.com/t/1909695497440292886

Treasury selloff, swap spread collapse, and rising yields signal a liquidity crunch, not inflation. Forced sales from leveraged funds and 60/40 portfolios are draining cash. BTC liquidation likely as well. The Fed will have to step in soon—unless they want markets to crash further. ( https://www.reuters.com/markets/rates-bonds/global-markets-tariffs-treasuries-analysis-2025-04-09/ | https://www.coindesk.com/markets/2025/04/09/bitcoin-longs-could-see-wave-of-liquidation-between-usd73-8k-usd74-4k-as-treasury-basis-trade-unwinds )

Treasury selloff, swap spread collapse, and rising yields signal a liquidity crunch, not inflation. Forced sales from leveraged funds and 60/40 portfolios are draining cash. BTC liquidation likely as well. The Fed will have to step in soon—unless they want markets to crash further. ( https://www.reuters.com/markets/rates-bonds/global-markets-tariffs-treasuries-analysis-2025-04-09/ | https://www.coindesk.com/markets/2025/04/09/bitcoin-longs-could-see-wave-of-liquidation-between-usd73-8k-usd74-4k-as-treasury-basis-trade-unwinds )

Write a comment...

Sort by